are political contributions tax deductible irs

Given that political donations arent tax deductible its important to familiarize yourself with IRS rules regarding the deductibility of charitable contributions. The political organization taxable income equals its gross income excluding exempt function income less deductions allowed by the Code that are directly connected with producing gross income excluding exempt function income computed with certain modifications set forth in 527 including a specific deduction of 100.

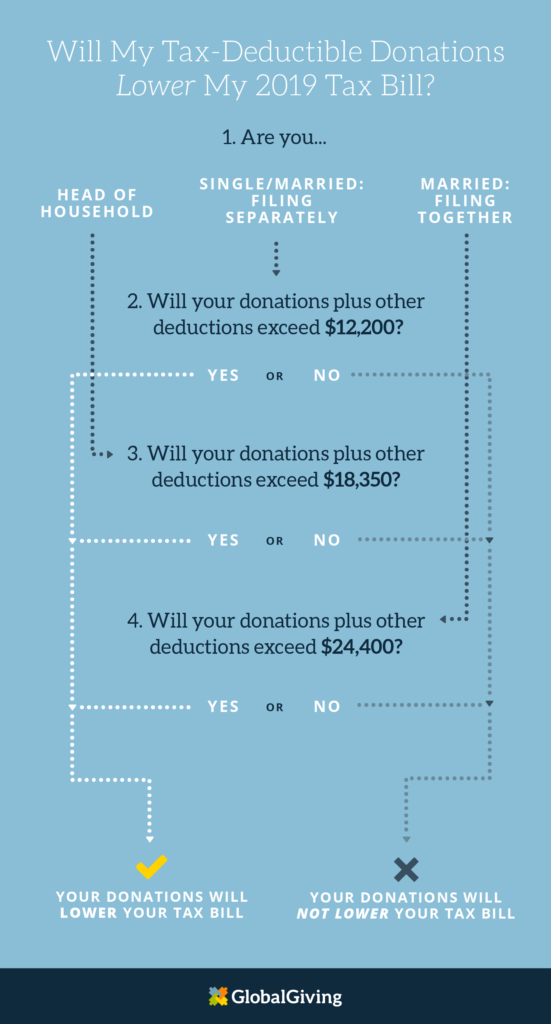

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Political contributions deductible status is a myth.

. Payment for any of these cannot be deducted from your taxes. If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are.

You can generally deduct cash securities and property donated to qualified charitable or 501 c 3 organizations on your federal income tax return. Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction. A lot of people assume that political contributions are tax deductible like some other donations.

Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible. As of 2020 four states have provisions for dealing with political contributions.

Generally the tax rate is the highest corporate tax rate. And political action committees are all political organizations under IRC 527. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

The answer is no as Uncle Sam specifies that funds contributed to the political campaign cannot be deducted from taxes. Generally individuals cant deduct business entertainment expenses until the 2026 tax year thanks to tax reform. You can generally deduct cash securities and property donated to qualified charitable or 501c3 organizations on your federal income tax return.

Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. A tax deduction allows a person to reduce their income as a result of certain expenses. In 2022 an individual may donate up to 2900 to a candidate committee in any one federal election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party.

Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate arent deductible. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. Given that political donations arent tax-deductible its important to familiarize yourself with IRS rules regarding the deductibility of charitable contributions.

At tax time remember that state tax laws frequently differ from those of the IRS. Here are other examples of items that Uncle Sam stipulates that one cannot deduct. You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate.

Individuals abroad and more. This means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these contributions will not be tax-deductible. Political contributions are not tax deductible though.

And businesses are limited to deducting only a portion. Montana offers a tax deduction. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method. Tax Rate - Political Organization Taxable Income. There are five types of deductions for individuals work.

You cant deduct contributions made to a political candidate a campaign committee or a newsletter fund. Congress however the tax is calculated using the regular graduated tax rates. Political contributions arent tax deductible.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. Among other requirements most tax-exempt political organizations have a requirement to file periodic reports on Form 8872 with the IRS. Given that political donations arent tax deductible its important to familiarize yourself with IRS rules regarding the deductibility of charitable contributions.

You can generally deduct cash securities and property donated to qualified charitable or 501 c 3 organizations on your federal income tax return. For you and your family. If the organization is the principal campaign committee of a candidate for US.

Campaign committees for candidates for federal state or local office.

Are Political Contributions Tax Deductible Anedot

Tax Deductible Donations Can You Write Off Charitable Donations

Are Political Contributions Tax Deductible Personal Capital

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Are Political Contributions Tax Deductible Smart Asset

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are My Donations Tax Deductible Actblue Support

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Why Political Contributions Are Not Tax Deductible

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Business Expense Understanding In A Nutshell

Are Donations Or Contributions To Foreign Charitable Organizations Tax Deductible Universal Cpa Review

Are Political Contributions Tax Deductible For Partnerships Ictsd Org

Are Political Contributions Tax Deductible Smart Asset

Are Your Political Contributions Tax Deductible Taxact Blog

Are Contributions To A Political Organization Tax Deductible Universal Cpa Review

Are Political Donations Tax Deductible Credit Karma Tax

Are Political Contributions Tax Deductible Smart Asset

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving